How do you calculate return on investment (roi)? return on investment (roi) is calculated by dividing the profit earned on an investment by the cost of that investment. Erhalte heute die aktuellsten preise, marktkapitalisierung, handelswährungspaare, grafiken und daten für uniswap (uni) von der weltbesten tracking-webseite für kryptowährungspreise.

Roi return on investment definition, formula, calculation.

Return On Investment Roi Formula With Calculator

Brutto und netto berechnen (umsatzsteuer bzw. mehrwertsteuer) brutto ist der betrag mit, netto ohne steuer. in deutschland ist der normale mehrwertsteuersatz 19%, der ermäßigte ist 7%. Return on investment or roi is a profitability ratio that calculates the profits of an investment as a percentage of the original cost. in other words, it measures how much money was made on the investment as a percentage of the purchase price.

Roa formula / return on assets calculation. return on assets (roa) is a type of return on investment (roi) roi formula (return on investment) return on investment (roi) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. it is most commonly measured roi formel as net income divided by the original capital cost of the investment. Conclusion. payback period is an essential assessment during calculation of return from a particular project and it is advisable not to use the tool as the only option for decision making.

Roi shoes_business = (2800-2000) * 100 / 2000 = 40%. so, through roi, one can calculate the best investment option available. we can see that investor book more profit in the business of shoes as the return on investment is the shoe business is higher than the bakery business. top 4 methods to calculate return on investment (roi). Return on investment is one of the most important indicators in accounting and has a long tradition. this value is situated at the top of the dupont model and is thus at the center of the world’s oldest business indicator system. this model was introduced in 1919 by the american chemical company e. i. du pont de nemours and company. roi refers to the return in relation to the invested capital.

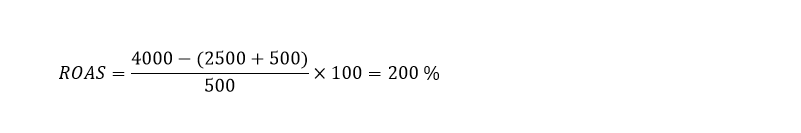

A quick example of how roi for a range of marketing campaigns could be calculated in excel. important roi formel note: "return" could be calculated using a range of mea.

Where: desired income = minimum required rate of return x operating assets. note: in most cases, the minimum required rate of return is equal to the cost of capital. the average of the operating assets is used when possible.. example: computation of ri. compute for the residual income of an investment center which had operating income of $500,000 and operating assets of $2,500,000. Human capital roi or hcroi is an hr metric that evaluates the financial value added by your the workforce against the money spent on them in terms of salaries and other benefits. in layman terms, it is the amount of profit obtained by any organization against every dollar invested in their human capital compensation. the hcroi shows the ratio of income derived against the total employment costs. Return on invested capital (roic) is a way to assess a company's efficiency at allocating the capital under its control to profitable investments. Œdipe Œdipe et le sphinx de gustave moreau 1864, metropolitan museum of art. activité roi de thèbes famille laïos (père) jocaste (mère et femme) Étéocle et polynice (fils) antigone et ismène (filles) modifier Œdipe (en grec ancien Οἰδίπους / oidípous « pieds enflés ») est un héros de la mythologie grecque. il fait partie de la dynastie des labdacides les rois.

Return On Invested Capital Roic Definition

Return on investment formula step by step roi calculation.

Return on investment (roi) is an economic indicator for the profitability of an economic unit’s (e. g. a company) invested capital. in the dupont model, this value is calculated as a product of return on sales and asset turnover. Roi example 3. a homeowner is considering a home renovation to add an extension and pool. the home is currently appraised at $500,000 and the renovations will cost $100,000 but they're also expected to increase the value of the home by $250,000. in this case, the return on investment would be: return on investment interpretation.

Formel zur berechnung des roi der nettoumsatz lässt sich aus der formel herauskürzen, sodass man zur vereinfachten formel gelangt. in der dupont-kennzahlenpyramide liegen umsatzrendite und kapitalumschlag direkt unter dem return on investment als spitze, wie die nachfolgende grafik verdeutlicht. Use of roi formula. the return on investment formula is used loosely in finance and investing. it can be applied to any form of investment including projects within a corporation, a company as a whole, a personal investment by an individual, and investment in an appreciable asset.

Social media return on investment (roi) is simply a measurement of efficiency. it’s a lot of things to a lot of people: “return on inactivity,” “return on innovation” and “return on engagement. ” however, in a stricter sense, social media roi is defined as a measure of the efficiency of a social media marketing campaign. this. Return on assets (roa) is a type of return on investment (roi) roi formula (return on investment) return on investment (roi) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. it is most commonly measured as net income divided by the original capital cost of the investment. Workout assumption: the assumption of an existing mortgage by a qualified, third-party borrower from a financially distressed borrower. by having someone else assume the mortgage, the financially.

Return On Investment Formula Step By Step Roi Calculation

Outputs after running the return on investment calculator. investment gain the total earnings or loss on the investment, i. e. the final value minus the starting value total return on investment the total percentage gain (the true roi) on the investment over the entire timeframe compound annual growth rate the value of the total return when converted to an annual gain or loss. The return on investment formula is used in finance by corporations in any form of investment like assets, projects, etc. it measures the return on investment like return on assets, returns on capital, etc. benefits of return on investment. › roi formula (return on investment) what is return on investment (roi)? return on investment (roi) is a financial ratio financial ratios financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company used to calculate the benefit an investor will receive in relation to their investment cost.

Alternatives to the roi formula. there are many alternatives to the very generic return on investment ratio. the most detailed measure of return is known as the internal rate of return (irr). internal rate of return (irr) the internal rate of return (irr) is the discount rate that makes the net present value (npv) of a project zero. in other words, it is the expected compound annual rate of. Return on investment (roi) is a popular metric used to assess an investment's efficiency or profitability. roi is calculated by dividing the net return earned on an investment by its total cost. Return on investment (roi) is a measure of the profit earned from each investment. like the “return” (or profit) that you earn on your portfolio or bank account, it’s calculated as a percentage. in simple terms, the roi formula is: (return investment) investment. it’s typically expressed as a percentage, so multiply your result by 100.

Einführung in studientechniken: die zentrale studienberatung informiert studierende aller fachrichtungen im blog "fit fürs studium" roi formel über studienund lerntechniken, anlaufstellen und unterstützungsangebote an der universität paderborn. fachkenntnisse auffrischen: in studienfächern mit einem hohen matheanteil stehen für studienanfänger*innen. Return on capital (roc), or return on invested capital (roic), is a ratio used in finance, valuation and accounting, as a measure of the profitability and value-creating potential of companies relative to the amount of capital invested by shareholders and other debtholders. it indicates how effective a company is at turning capital into profits. the ratio is calculated by dividing the after. More roi formel images.